With the value-add syndication investment model, there are two primary strategies that Sponsors use to structure deals and acquire assets: the fund approach and single asset approach.

Using the fund approach, Operators acquire multiple properties via one offering and investors typically do not get to choose or vet every asset, although some funds may have identified a handful of target properties prior to the offering being launched, but usually not all. Like with the single asset approach single asset approach, investors must have a high degree of trust in the Operator with this approach, albeit it can be argued that you need MORE trust in the Operator here, since you do not get to the asset(s).

Conversely, single asset offerings include just one asset; think one apartment complex, one self-storage facility, one mobile home park, one office complex, etc. Because the asset to be acquired has been identified and is described in the offering, investors can vet said asset. Unlike with a fund, investors are able to analyze proformas, confirm inspections, review property specific business plans, physically visit the property, and so forth. Faith in the Operator is still vitally important here.

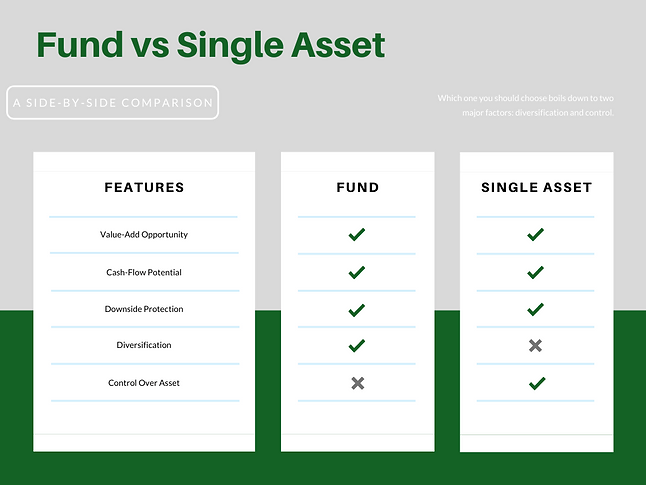

Let’s take a closer look at the two strategies side by side.

Assuming that you have vetted the Operator, both of these approaches are great options as reliable investment vehicles. They both have value-add opportunity, so appreciation can be forced and you can grow your money. They both have cash-flow potential, so you can secure regular returns and receive “mailbox money.” And they both offer downside protection, so your losses are minimized (or potentially nonexistent) during a down market.

Speaking of vetting an Operator, it is my opinion that the Operator has the most impact on the success of the deal (I dive into that in detail here). With this assertion, I can point out that the choice of fund or single asset approach does not vary that greatly since the Operator, and your trust in that Operator, is the key factor, and that trust should translate to your confidence in their choice of asset. After all, most investors choose syndication because they want to be passive, not because they want to be out in the field identifying opportunities, acquiring assets, implementing the business plan, managing the property, and so forth. Which is why they have chosen a reliable and trustworthy Operator.

So, if both are great investment options and equally reliable and proven Operators make them similar choices, how do you decide between the two, especially if projected returns are similar? The answer to that question will vary by investor, and it really boils down to your preference of two factors – diversification or control. If you value control, or the ability to decide which asset you invest your money in, the single asset approach might be for you. If you are more concerned with diversification and are comfortable with allowing the Operator you have chosen to identify and acquire properties, then the fund approach is more in line with your investment criteria.