I am often asked questions about the filing status of my Sponsors and, more specifically, the offerings that they provide to investors. A few of the most common questions are:

- Will they be allowing non-accredited investors to participate on this specific deal?

- Is this offering structured as a 506(b) or 506(c)?

- What does 506(b) or (c) even mean?

- What affect does filing status have on the eligibility of investors?

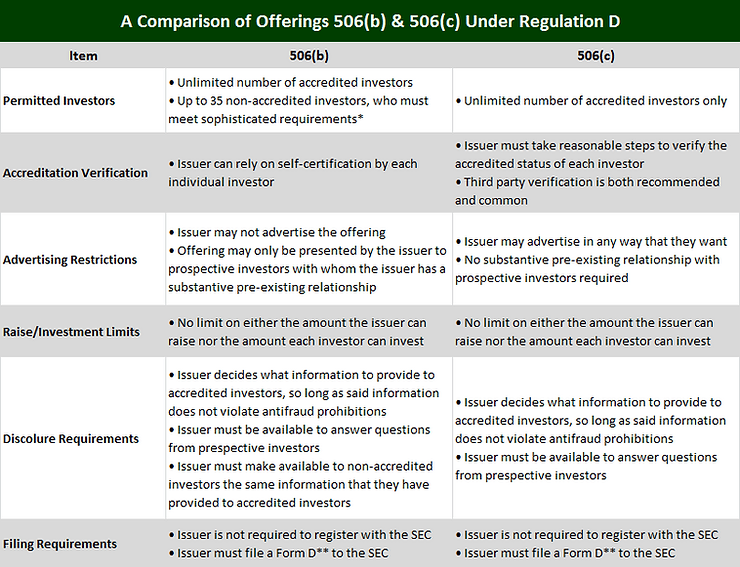

While most people understand that commercial real estate syndication offerings have to be registered with the United States Securities and Exchange Commission (SEC) in some way shape or form, they are often unaware of the specifics. When considering commercial real estate syndication in general (apartments, self-storage, mobile home parks, retail space, etc.), the most commonly used method of filing is Regulation D (Reg D), rules 506(b) & 506(c). Before I provide a simple, easy to follow chart outlining the key elements of each, let me first lay some ground work.

- Commercial real estate syndication offerings are considered securities in the eyes of the SEC. Any company that offers such securities must register with the SEC, unless they meet certain qualifications to exempt them.

- Reg D outlines the above mentioned exemption qualifications. The initial intention of Reg D was to allow smaller companies, which likely could not afford the standard SEC registration, a chance to access the capital markets. Key conditions that must be met to qualify for Reg D are as follows: all sales that are part of the same Reg D offering must be “integrated,” or treated as one offering; information and disclosures must be provided to investors; the securities being sold must contain restrictions on their resale.

So, if a company meets the requirements of Reg D, which exempts them from registering with the SEC, they are then faced with the decision on whether they want to structure as a 506(b) or a 506(c) offering. Let’s take a look at how the two compare.

Closing Thoughts

If I had to answer the question “what is the most common filing status among commercial real estate sponsors?” (which I have, many times), I would answer 506(b). To provide more depth to this answer, let me add that you will often see these offerings filed as a 506(b) with no spots open for non-accredited investors. By structuring this way, it (1) eliminates the need for accreditation verification through extra (resource consuming) measures or third party involvement, (2) reduces the number of necessary steps in turn minimizing opportunities for mistakes and (3) saves accredited investors from disclosing personal information such as W-2s, bank statements, brokerage account statements, etc., which they might otherwise be required to provide if non-accredited investors are involved.

The one downfall to this structure is that the Sponsor is then unable to advertise the offering. However, from my experience, this does not present a major concern as any reputable and successful Sponsor will likely have accredited investors, with whom they have a pre-existing relationship, lined up at the door waiting to get in to their next deal.

*The SEC defines a sophisticated investor as one who has “sufficient knowledge and experience in financial and business matters to make them capable of evaluating the merits and risks of the prospective investment.” As you can see, there is no hard, steadfast rule here, leaving sophisticated status open for interpretation.

** Form D is a brief notice that includes general information on the company’s operators, but little information on the company itself. It is filed after the sale of securities. If you are interested in checking the filing status of any specific offering, you can search the SEC’s EDGAR database here.